Welcome

INGA BARKAUSKAITE, MBA, MST

Director & CEO @ Mega Commercial Enterprises Limited

Email: [email protected]

Phone: +353 (87) 148 3870

About me

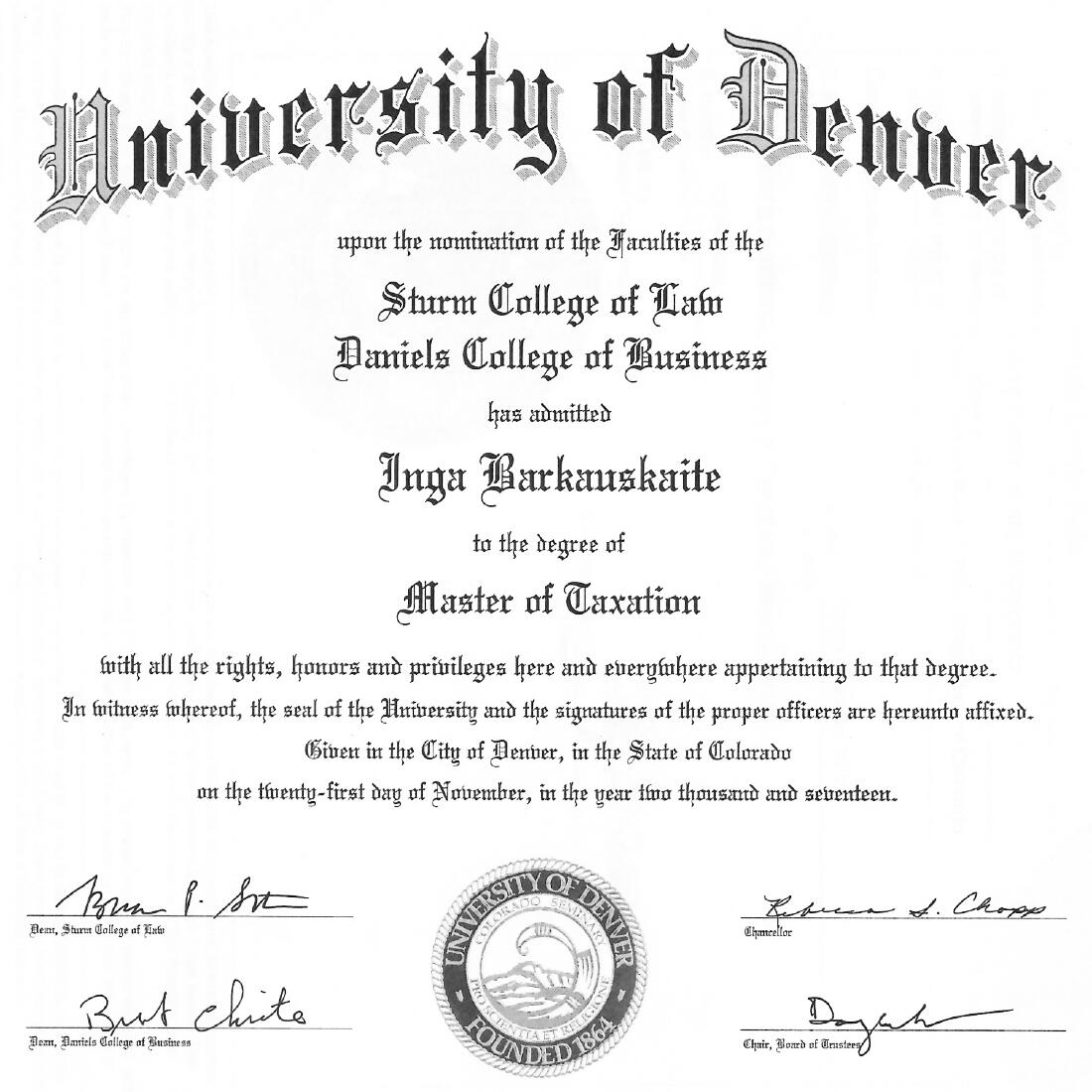

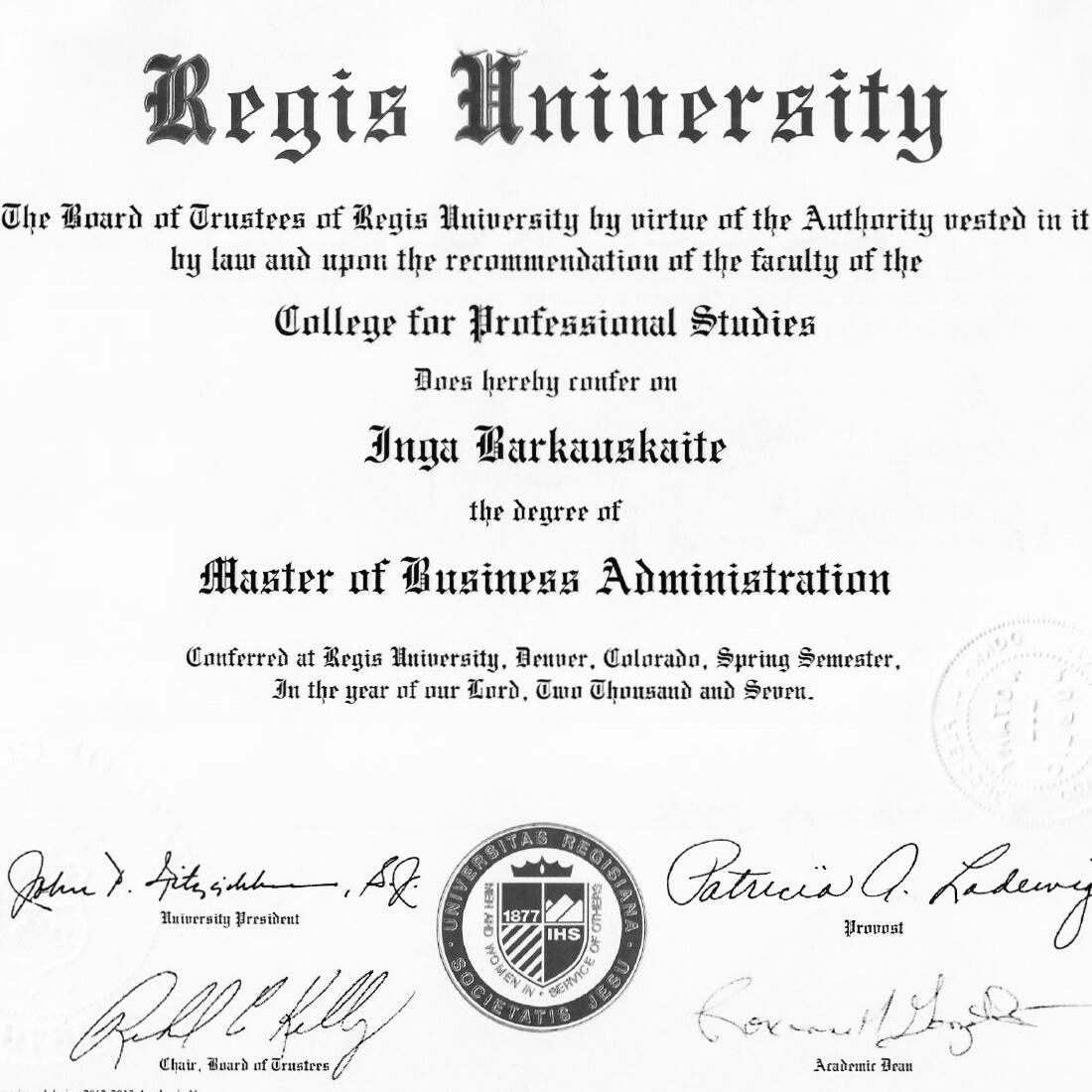

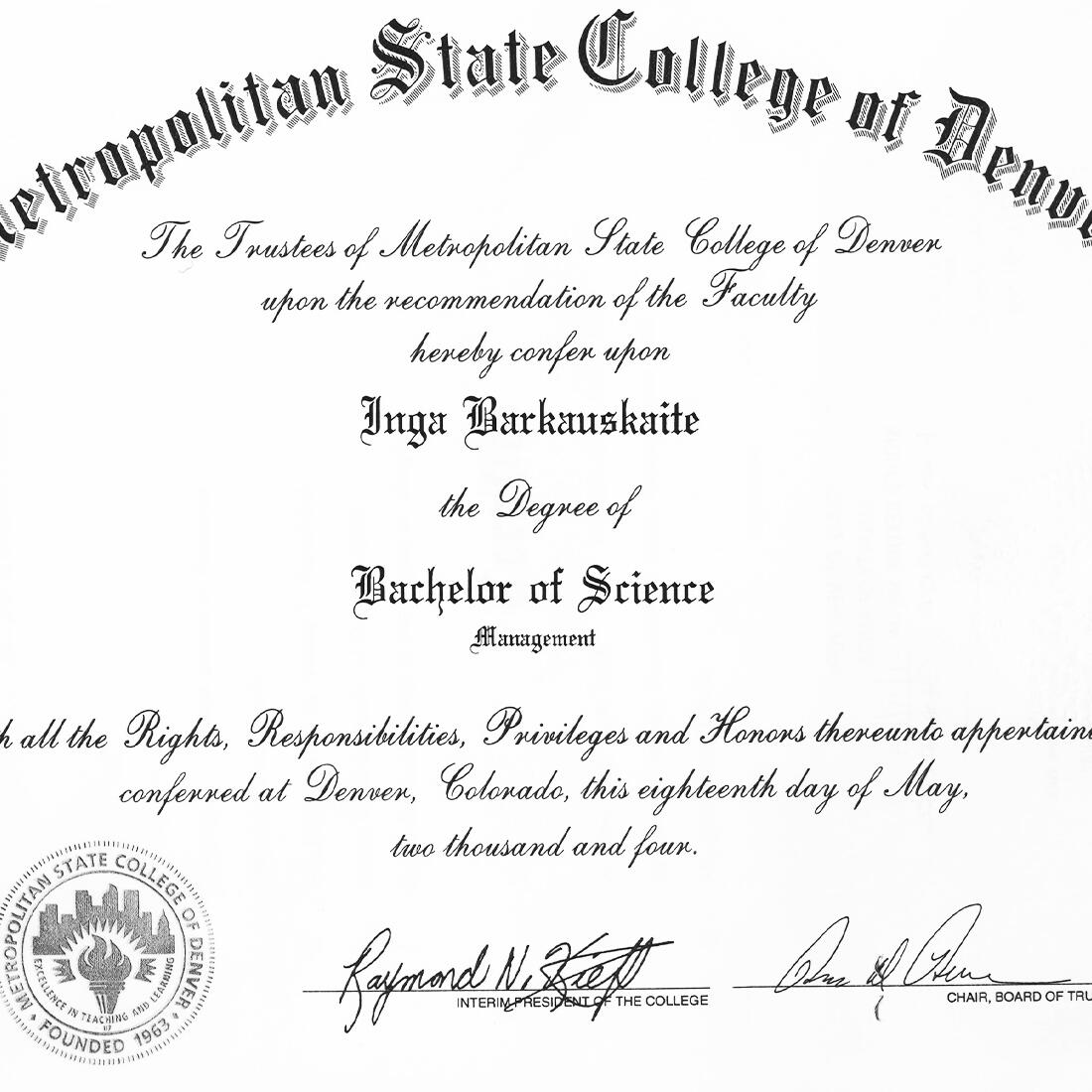

Hello and welcome! With more than 20 years of experience in business and tax planning, technology, economics, business automation, and leadership training, I am a highly qualified and versatile professional capable of adapting to any challenge that comes my way. My educational background includes a Bachelor’s degree in Management from Metropolitan State College of Denver, an MBA from Regis University, and a Master of Taxation degree from the Sturm College of Law at the University of Denver. I have collaborated with Fortune 500 companies, worked as a Tax Manager, served in the government sector, and pursued entrepreneurial ventures.

My work

Director at Mega Commercial Enterprises Limited

As Director & CEO at Mega Commercial Enterprises Work Duties:

Leverage expertise in taxation and business administration to provide strategic advisory services to clients across various industries.

Conduct comprehensive tax planning and structuring analyses, identifying opportunities for tax optimization while ensuring compliance with relevant regulations.

Develop and implement tax-efficient strategies for clients' domestic and international operations, including holding company structures, intellectual property management, and finance/treasury operations.

Collaborate with cross-functional teams to deliver integrated solutions that align tax considerations with broader business objectives, such as mergers and acquisitions, supply chain restructuring, and digital transformation initiatives.

Provide guidance on tax implications of e-commerce activities, including cross-border transactions, digital services and business automation.

Continuously stay updated on evolving tax regulations, case laws, and industry best practices to ensure clients receive the most current and effective advice.

Key Skills

Strong understanding of business administration, including strategy formulation, financial analysis, operational management and business automation.

In-depth knowledge of domestic and international taxation principles, regulations, and reporting requirements.

Expertise in corporate tax planning, transfer pricing, tax treaty analysis, and cross-border transactions.

Proficiency in analyzing complex tax and business scenarios, identifying risks and opportunities, and developing strategic recommendations.

Excellent communication and interpersonal skills, with the ability to effectively convey technical tax concepts to non-tax professionals.

Strong analytical and problem-solving abilities, with a keen attention to detail.

Proven leadership and project management skills, with the ability to coordinate cross-functional teams and deliver results within defined timelines.

Continuous professional development and commitment to staying updated on the latest tax and regulatory developments.

Continuous professional development mindset, staying updated on the latest technology news and regulatory developments, industry best practices, and emerging trends.

Ability to navigate the complexities of international taxation, including cross-border transactions, e-commerce taxation, and indirect tax compliance.

company

About Mega Commercial Enterprises Limited

Mega Commercial Enterprises Limited is a prominent player in the global business landscape, known for its diverse portfolio and robust market presence. Established with a vision to innovate and lead, the company operates across multiple sectors including retail and technology. With a commitment to excellence and sustainability, Mega Commercial Enterprises Limited has built a reputation for delivering high-quality products and services. The company prides itself on its strategic investments, dynamic growth strategies, and its ability to adapt to changing market conditions, making it a trusted name among consumers and investors alike. You can read more at MCEL.ai.

My education

Professional Licenses & Diplomas

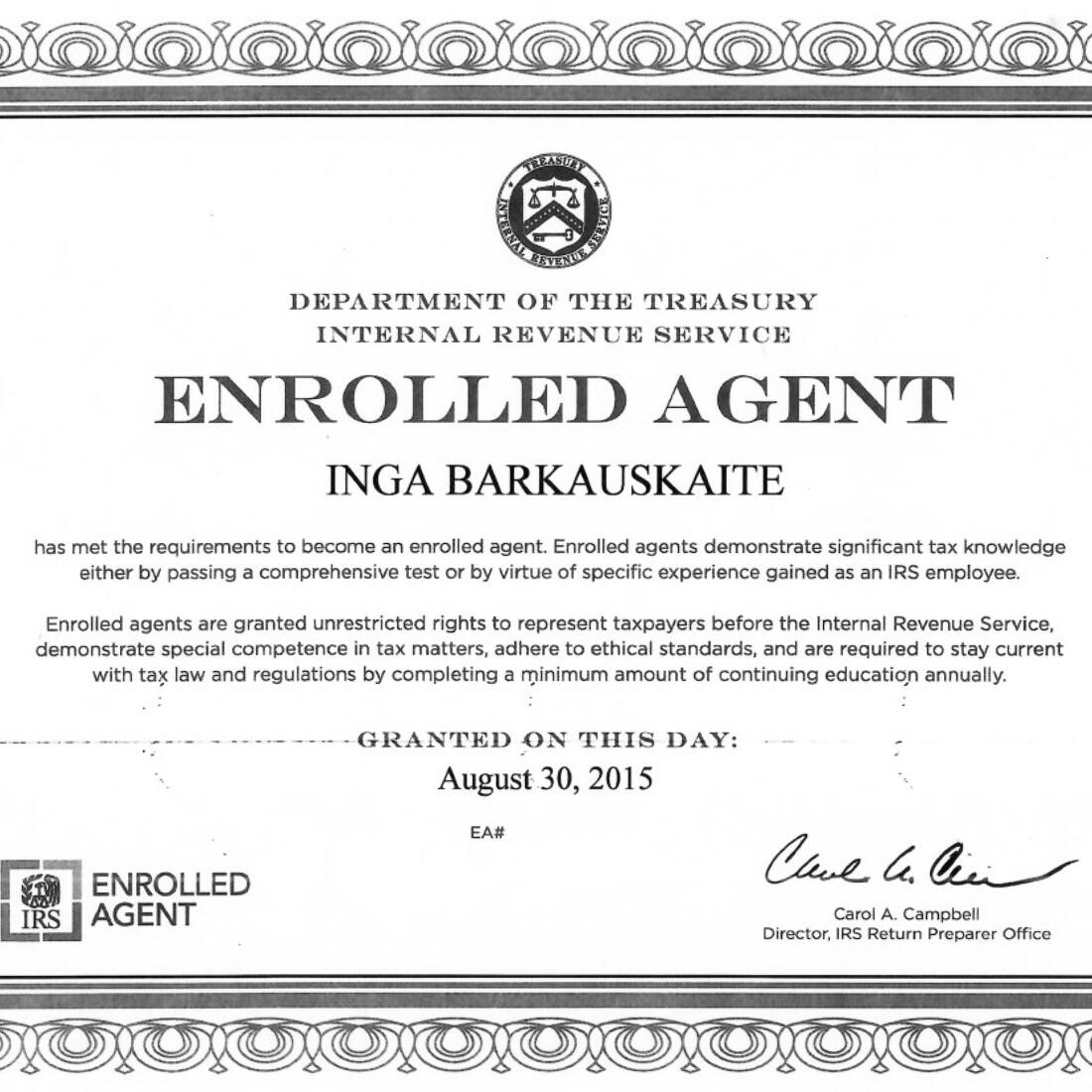

I obtained a Bachelor of Science degree in Management from Metropolitan State College of Denver, conferred on May 18, 2004. This undergraduate degree provided me with a foundation in business administration, management principles, and related disciplines.I pursued further education at Regis University in Denver, Colorado. In the Spring Semester of 2017, I was awarded a Master of Business Administration (MBA) degree from the College for Professional Studies at Regis University. This advanced degree equipped me with comprehensive knowledge and skills in various aspects of business administration, including finance, marketing, operations, strategy, and leadership. In 2015, I received the IRS Enrolled Agent License.Additionally, I completed a Master of Taxation program at the University of Denver’s Sturm College of Law and Daniels College of Business. On November 21, 2017, I was awarded the Master of Taxation degree, which provided me with in-depth expertise in taxation laws, regulations, and practices, both domestically and internationally.More recently, in 2021, I successfully completed the IBFD Advanced Professional Certificate in International Taxation from the International Bureau of Fiscal Documentation (IBFD). This specialized certificate program covered various aspects of international taxation, including tax treaties, transfer pricing, international tax planning, and common structures such as holding, IP, finance, and services companies.

Fields of expertise

Continuous learning and Professional development.

01

International Tax

Specializing in U.S. international taxation with a balanced focus on both inbound and outbound transactions. Expertise includes resident and nonresident alien taxation, withholding taxes, effectively connected income (ECI), foreign investment in U.S. real estate, tax treaties, branch taxes, earnings stripping, conduit financing rules, foreign earned income exclusion, foreign tax credits, controlled foreign corporations (CFCs), passive foreign investment companies (PFICs), export transactions, Subpart F manufacturing rules, outbound property transfers, and transfer pricing.

02

Individual Tax

Using the Internal Revenue Code and Federal Income Tax Regulations as a foundation, I address substantive issues related to individual taxation. My areas of expertise include general concepts of gross income, employee benefits and deductions, charitable deductions, the alternative minimum tax, the deductibility and classification of interest, taxation of home offices and vacation homes, and an overview of the interrelationships between various statutory and non-statutory principles.

03

Corporate Tax

I specialize in federal income taxation of corporations and their shareholders, with a focus on the creation of corporations, establishment of capital structures, operational alternatives, distributions to shareholders, stock dividends and redemptions, personal holding companies, and accumulated earnings tax. I address advanced corporate taxation issues, including liquidations, detailed applications of sections 305, 306, and 307, loss carryovers, and Subchapter S corporations.

04

Fiduciary Income Tax

I specialize in federal income taxation of estates and trusts. This includes understanding the concepts of estates and trusts, trust accounting income for simple and complex trusts, and the calculation of taxable income. Special rules include the calculation of distributable net income, capital gains, personal exemptions, and charitable contributions. I also focus on the separate share rule, trapping distributions, income in respect of a decedent, the grantor trust rules under sections 671-678, and the calculation of the alternative minimum tax.

05

State & Local Tax

I specialize in taxable incidents, privilege tax, discrimination, and multiple taxation under the Commerce Clause of the United States Constitution. My experience covers sales of tangible personal property, retail and wholesale sales, taxable and nontaxable leases, the contractors rule, exemptions, and resale certificates under sales and use tax statutes. I also focus on the multi-state tax compact, the unitary concept, definitions of residence, nonresident income sources, tax credits, and short-period returns for individual income taxpayers.

06

Property Taxation

I specialize in the basis of property, comparing capital expenditures and current expenses, determining depreciable status, and amortization of intangible property. My expertise includes various depreciation methods, handling property casualties and losses, computing and characterizing profit or loss for taxable property dispositions, and understanding limitations on passive losses. Additionally, I have experience with lessor and lessee reporting and tax-deferred dispositions.

07

Partnership Taxation

I specialize in the tax treatment of partnership income in the hands of the partner, adhering to the conduit rule. My expertise includes addressing problems associated with the formation, operation, and dissolution of partnerships, the sale of partnership interests, and the withdrawal and retirement of partners. I also focus on basis adjustments, unrealized receivables, and substantially appreciated inventory.

08

Tax Accounting

I specialize in the adoption of and changes in accounting periods, and the recognition of income and deduction allowances under the cash and accrual methods, including considerations of the time value of money. My expertise covers prepaid and contested income and expenses, income and deduction reversals, accounting method and practice changes, installment sales, and long-term contracts.

09

Tax Research & Writing

Research sources, techniques, and practice; in-depth research of selected areas. Emphasis on argument and communication of conclusions; evaluation of legislative history and administrative authorities.

10

Employment Tax

Explore existing employment tax risks, recognise employment tax planning opportunities through appropriate compensation and entity structuring techniques, analyse proper worker classification, and highlight preventative techniques to avoid personal liability.

11

Exempt Organisations

The statutory exemption for "charities," social welfare and social clubs, homeowners' associations, fraternal orders, employee benefit organisations, mutual or cooperative companies, business and professional leagues, labor unions, exempt organisations, property title companies, federally organised or chartered organisations, and political organisations’ activities, funds, and lobbying activities; prohibited transaction rules; the private foundation; the unrelated business and debt-financed income tax exposures; excise tax exemptions; administrative appeal and declaratory judgment procedures; anti-discrimination considerations; charitable contributions.

12

Representation

Issues facing individual taxpayers embroiled in conflict with the Internal Revenue Service or in litigation before the United States Tax Court (innocent spouse relief, earned income credit, dependency exemptions, appeals of audits and collection due process issues, tax litigation). Representing taxpayers regarding such issues in all facets of practice before the IRS. Representation of taxpayers in tax audits, appeals, collection proceedings. All facets of client representation, including initial client meetings, representation agreements and client advocacy.

13

Business Development

Issues facing individual taxpayers embroiled in conflict with the Internal Revenue Service or in litigation before the United States Tax Court (innocent spouse relief, earned income credit, dependency exemptions, appeals of audits and collection due process issues, tax litigation). Representing taxpayers regarding such issues in all facets of practice before the IRS and the Tax Court. Representation of taxpayers in tax audits, appeals, collection proceedings. All facets of client representation, including initial client meetings, representation agreements and client advocacy.

14

Business Automation

Expertise in business automation involves leveraging advanced technologies to streamline and optimize business processes, reducing manual intervention and increasing efficiency. This includes the implementation of software solutions such as robotic process automation (RPA), artificial intelligence (AI), machine learning (ML), and enterprise resource planning (ERP) systems. Deployment of automated workflows that enhance productivity, improve accuracy, and enable real-time data analysis. This ensures seamless integration of automation tools with existing systems, driving operational excellence and fostering innovation within organizations.

15

Business Strategy

Business strategy will help you make change sustainable through new ways of optimizing culture and business impact. Digitalization and consumer expectations are changing the way we interact with each other. Organizations that know how to adapt, will be successful.

16

Business Startup Consulting

With our startup business consulting services, you can confidently take your business idea from conception to success. Let us be your partners in building a strong foundation for your startup's growth and prosperity. Contact me today to discuss how we can support your entrepreneurial dreams!

Inga Barkauskaite's References

Tax Consultation

$800 per hour

Tax consultation services provide comprehensive expertise tailored to individuals and businesses navigating complex tax landscapes. We offer personalized advice on optimizing tax efficiency, compliance with current regulations, and strategic planning for short-term and long-term financial goals. Whether you’re seeking guidance on individual tax returns, corporate tax strategies, estate planning, or international tax matters, our team ensures meticulous attention to detail and a commitment to delivering tailored solutions that meet your unique needs.

Individual Tax Consultation: Personalized advice and planning for individuals, including optimizing deductions, credits, and strategies for minimizing tax liabilities on personal income, investments, and assets.

Business Tax Consultation: Strategic guidance for businesses of all sizes, including entity selection, tax planning, compliance with tax laws and regulations, deductions and credits optimization, and advice on mergers, acquisitions, and expansions.

International Tax Consultation: Specialized advice for individuals and businesses engaged in cross-border transactions, addressing issues such as foreign income reporting, tax treaties, transfer pricing, foreign tax credits, and compliance with international tax regulations.

Business Consultation

$500 per hour

Business consultation services provide strategic guidance and solutions tailored to your organization’s needs. Whether you’re a startup, small business, or established corporation, we offer expertise in areas such as business planning, financial analysis, operational efficiency, market strategy, and growth planning. Our consultations are designed to identify opportunities for improvement, optimize processes, and enhance overall business performance. With a focus on practical solutions, we help businesses achieve their goals and navigate challenges effectively.

Business Strategy Consultation: Strategic guidance focused on defining business goals, market positioning, competitive analysis, and long-term growth planning. This type of consultation helps businesses develop clear objectives and actionable plans to achieve sustainable success.

Financial Consultation: Expert advice on financial management, budgeting, cash flow analysis, investment strategies, and risk management. Financial consultations aim to optimize financial performance and enhance profitability.

Business Automation Consultation: Specialized consultation focused on leveraging technology and automation tools to streamline processes, improve operational efficiency, and reduce costs.

"Success is not final; failure is not fatal: it is the courage to continue that counts."

Winston Churchill

Interested in working with me?

Feel free to get in touch with me for any inquiries, collaborations, or opportunities. I’m here to help you with your business and tax planning needs, provide insights on technology and economics, and offer guidance in leadership training. With over two decades of experience, I bring a wealth of knowledge to the table. Whether you’re a Fortune 500 company seeking consultation or an individual looking for expert advice, I am here to assist you every step of the way. Don’t hesitate to reach out – I look forward to connecting with you!

Thank you

Elevating Your Business Potential. Solutions Tailored for Success.